Quick Approvals with our Car Loan Calculator

Understand your monthly financial commitment prior to applying for a car loan. Start estimating today with our online car loan calculator!

Easily Schedule Vehicle Purchases to Work with Income and Cash Flow

Borrowers can better prepare themselves for the car buying process by using our free and online car finance calculator. It simplifies and streamlines the often tedious process of buying a car by automatically converting vehicle prices into loan repayments. Don’t waste time test-driving vehicles that you can’t afford. Weed out expensive makes and models and refine your shortlist to find a suitable car for your financial situation.

Many new or used car buyers end up over paying on their finance because they feel pressured to make decisions on the spot. Don’t let that happen to you! Our repayment estimator lets you plan ahead by easily comparing vehicles, financing options, rates and terms. It’s an invaluable car buyer’s tool for all types of vehicle buyers considering finance across Australia.

Get your motor vehicle finance estimate today and simplify your car buying experience.

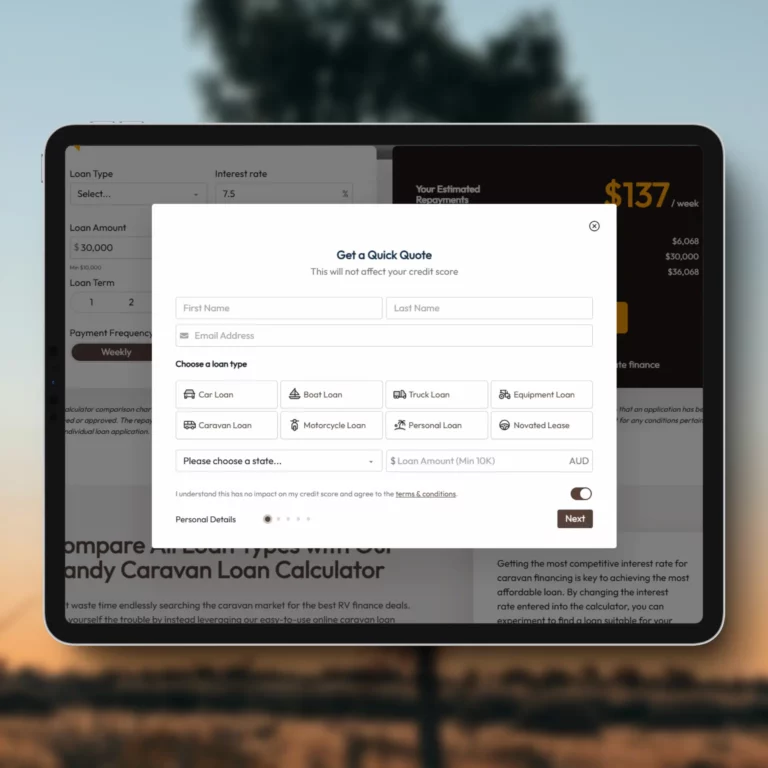

Using the device to calculate a repayment estimate for any motor vehicle is quick and easy. A variety of fields must be completed to use the device – loan amount, interest rate and loan term. When using the device, the biggest query we receive from borrowers is what interest rate they should enter. We recommend using our ‘best rates’ as a guide – these are the rates we are currently achieving and are highly competitive across the motor vehicle lending sector.

- Best rates on personal car loans - secured and unsecured.

- Full selection of commercial credit facilities available.

- Use our current best rates to calculate a repayment estimate.

Read more...

It is important to note that our ‘‘best rates’ should be used as a guide only. This is because interest rates vary across the market based on individual borrower profiles. For an accurate rate specific to your financial situation, give our expert brokers a call. We are accredited with 80+ banks and lenders and know exactly where to find the best rates for each financial situation. Connect with us online or by phone for a no-obligation tailored to your specific requirements.

Our versatile weekly, fortnightly and monthly car loan estimator can generate repayments for both personal and commercial credit facilities. In addition to lenders and individual borrower profiles, interest rates also vary between credit products.

When calculating a repayment based on our current ‘best rates’, ensure you enter the rate displayed for your preferred credit product. Once you have completed the required fields (interest rate, loan amount, loan term), click ‘calculate’ and instantly receive an estimated monthly repayment estimate.

Start estimating now – it’s free!

Make Better Buying and Financing Decision - Seize the Power of Our Car Loan Calculator

Don’t commit to purchasing a vehicle without first understanding the weight of your commitment. By leveraging the advantage of our online calculation device, you can quickly convert the price of your prospective motor vehicle into monthly repayments.

To start the process, simply enter the price of the car or the credit required as the ‘loan amount’, the appropriate interest rate, your preferred term. Hit ‘calculate’ and the monthly repayment estimate will be displayed.

Our online car loan repayment calculator can be used to convert the price of any motor vehicle into a monthly repayment estimate. The device is highly versatile and can generate estimates for both commercial and personal credit facilities. To compare different makes and models of vehicle, loan terms, and rates – just vary the relevant values and hit calculate.

Borrowers can easily set their financing preferences via the calculator. Whatever repayment frequency suits your specific financial requirements – weekly, fortnightly, monthly – the calculator can cater for it. Many buyers prefer to select a financing term that matches the years they intend to own a vehicle. This enables them to avoid exit fees if they finalise the finance or sell the vehicle before the end of the financing term.

If the estimated repayment displayed is too expensive for your financial situation, use the calculator to vary the entered details to achieve a repayment amount that works for you.

When buying a new or used car, it’s important that it aligns with your needs, lifestyle and budget. To determine whether your prospective motor vehicle is right for you, receiving a repayment estimate is vital. For most buyers, it’s more important than the RRP or driveaway price because it provides a clearer picture of affordability.

To make sure your vehicle choice is going to fit your income and budget, use our online car loan calculator. Adjust the loan amount and term until you find a repayment estimate that works for your preferences. Once you are happy with your estimate, give us a call and we’ll provide a firm quote and help you start the loan application process.

Understanding how the price of a vehicle can convert to repayment estimates is an instrumental piece of information for gaining greater confidence during the purchasing process. From budget models right through to mid-range makes and high-end luxury vehicles – our online calculator is an invaluable device for comparing multiple vehicles and credit facilities. Find a model that suits your budget and approach the purchase with greater peace of mind.

Convert Car Price Tag to Monthly Repayments

Don’t commit to purchasing a vehicle without first understanding the weight of your commitment. By leveraging the advantage of our online calculation device, you can quickly convert the price of your prospective motor vehicle into monthly repayments.

To start the process, simply enter the price of the car or the credit required as the ‘loan amount’, the appropriate interest rate, your preferred term. Hit ‘calculate’ and the monthly repayment estimate will be displayed.

Estimate Any Vehicle – cab chassis, passenger models, wagons, SUVs, sports, luxury, EVs

Our online car loan repayment calculator can be used to convert the price of any motor vehicle into a monthly repayment estimate. The device is highly versatile and can generate estimates for both commercial and personal credit facilities. To compare different makes and models of vehicle, loan terms, and rates – just vary the relevant values and hit calculate.

Determine Your Preferred Repayment Schedule

Borrowers can easily set their financing preferences via the calculator. Whatever repayment frequency suits your specific financial requirements – weekly, fortnightly, monthly – the calculator can cater for it. Many buyers prefer to select a financing term that matches the years they intend to own a vehicle. This enables them to avoid exit fees if they finalise the finance or sell the vehicle before the end of the financing term.

If the estimated repayment displayed is too expensive for your financial situation, use the calculator to vary the entered details to achieve a repayment amount that works for you.

Plan Ahead, Avoid Over-Spending, Stick to Budget

When buying a new or used car, it’s important that it aligns with your needs, lifestyle and budget. To determine whether your prospective motor vehicle is right for you, receiving a repayment estimate is vital. For most buyers, it’s more important than the RRP or driveaway price because it provides a clearer picture of affordability.

To make sure your vehicle choice is going to fit your income and budget, use our online car loan calculator. Adjust the loan amount and term until you find a repayment estimate that works for your preferences. Once you are happy with your estimate, give us a call and we’ll provide a firm quote and help you start the loan application process.

Be More Confident in Your New or Used Car Purchase

Understanding how the price of a vehicle can convert to repayment estimates is an instrumental piece of information for gaining greater confidence during the purchasing process. From budget models right through to mid-range makes and high-end luxury vehicles – our online calculator is an invaluable device for comparing multiple vehicles and credit facilities. Find a model that suits your budget and approach the purchase with greater peace of mind.

Compare Cars and Tailor Loan Preferences Easily with Fast Motor Vehicle Repayment Estimates

- Assess vehicle affordability with simple repayment calculations.

- Find cars that match your budget by varying loan terms and amounts.

- Compare financing options to see what works best for you.

- Get a clear picture of your monthly repayments before committing.

- Tailor your car finance to suit your exact financial requirements.

How Does the Car Loan Calculator Work? Very simply! Use the Device Effectively with 3 Simple Steps

Regardless of your computer or maths competency, using the car finance calculator is easy! Just enter a few key values into the required fields and click ‘calculate’ – you’ll receive an instant repayment estimate for the motor vehicle you are considering.

The only details required to use the motor vehicle loan calculator is the price of the vehicle (the amount you want to borrow), an estimated interest rate based on the type of loan you want, and a preferred loan term of 1 to 7 years.

Once you have this information, all you need to do is fill out the required fields – like an online form! Choose a loan term that works for your ownership plans, or one that generates a suitable monthly repayment amount for your budget. You can even add a balloon or residual payment to further reduce the monthly loan payment displayed.

Once you have completed all the required fields, click ‘calculate’ and the device will show you the estimated monthly repayment for the values entered. To see what different loan amounts, vehicle prices, and loan terms look like, vary the relevant fields and recalculate. You can use the device as many times as you like, at any time and from anywhere.

It is important to remember that the repayments displayed are estimates. If you want a quote tailored to your specific financial situation, request one online or over the phone.

- Use the device anywhere and at any time.

- Compare repayments on a variety of motor vehicles.

- Understand your repayment commitment before test-driving vehicles.

Found a Suitable Loan Repayment Estimate? Get a Confirmed Quote, Apply Online, and Receive Fast Approval!

Getting car loan repayment estimates is very straightforward with Easy Equipment Finance. Our online calculation device is free, easy-to-use, and accessible anywhere and at any time.

Once you have found a suitable estimate for your prospective motor vehicle purchase, follow it up quickly and easily thanks to our streamlined quote and loan application process. Just give us a call for a confirmed quote specific to your financial situation, requirements and credit profile. We match each borrower with their ideal lender to ensure the best possible interest rates, terms and loan amounts are achieved.

On acceptance of your low-rate financing offer, start the car loan application process with the help of your very own dedicated motor vehicle financing specialist. We provide approvals within 24 hours for many applicants – ensuring a streamlined purchasing experience.

To get started, request a quote now!

The Most Frequently Asked Questions

How do I know what interest rate to enter when using the online car loan calculator?

We recommend referring to our ‘best rates’ when determining which interest rate to enter into the estimation device. Our ‘best rates’ are the ones we are currently achieving across the market. It is important to remember that interest rates vary based on individual credit profiles. For a more accurate rate tailored to your financial situation, reach out to one of our expert brokers.

Is using an online car loan calculator the same as applying for finance?

No. Our online car loan calculator is a pre-application resource for borrowers to compare motor vehicles and loan products to find a loan structure that aligns with their financial situation and budget. The calculator generates a no-obligation monthly repayment estimate based on the information entered by the user. After receiving an estimate that works for your financial situation, get in contact with one of our brokers for a confirmed quote and to begin the application process.

What is a balloon payment?

Balloon payments refer to a large lump-sum payment that is due at the end of a loan term. A balloon payment is often used in car financing and is implemented to reduce the monthly repayments during a loan period. At the end of the loan, a large final payment will be required to settle the loan.

What information will I require to use the car loan calculator efficiently?

To use our car loan calculator, you will need to enter the price of the vehicle, the interest rate, and the term for the loan (usually 1 to 7 years). By adjusting these values in the calculator, you can see different repayment estimates for different motor vehicles and credit facilities.

If the result calculated exceeds my budget, how can I lower the repayment figure?

If the calculated repayment amount exceeds your budget, you can adjust the values entered to find an estimate that works for your financial situation. Try reducing the loan amount by considering a cheaper car, or increase your loan term to lower the monthly repayments. Another option is to vary the interest rate if you can secure a better rate. By adding a balloon payment, you can also reduce your monthly repayments.

How do I determine which loan term is best for me?

To determine the best loan term, consider how long you intend to keep the car. The shorter the loan term, the higher the monthly repayments, but you will save on interest. The longer the loan term, the lower the monthly repayments, but you will pay more interest on the loan. It’s also extremely important to consider your budget when determining a loan term.

How can the car loan calculator help me with my budget?

Our estimation device helps borrowers assess whether they can afford a particular type of car. By using the tool, you can achieve a better idea of what your monthly repayments will be and whether those repayments fit into your budget. By inputting the loan amount, rate and term, you will be able to see if the repayments are going to be too high. If they are too high, you can adjust the entered value to see if you can find a combination that works.

What do I do after finding a repayment estimate that aligns with my needs?

After achieving a repayment estimate that fits your financial situation and budget, give one of our dedicated brokers a call for a confirmed quote. You can reach out online or by phone. Our brokers will provide you with a tailored quote specific to your borrowing profile and credit history. If you are happy with the quote offered, proceed to the loan application. We provide approval to most borrowers within 24 hours to ensure you can quickly move forward with your car purchase.

How do I use the car loan calculator?

To use the calculator, input three key pieces of information – the vehicle price (loan amount), the interest rate (based on our ‘best rates’), and your preferred loan term (between 1 and 7 years). After entering the values, click ‘calculate’ and instantly receive an estimated monthly repayment based on the information entered. Tweak any fields to compare different cars, loan terms, rates and loan products. The calculator is instrumental in helping you find the best financing option for your budget.

Can I use the calculator for both personal and commercial car loans?

Yes. Our calculator is highly versatile and can calculate repayments for both personal and commercial car loans. Depending on what purpose you need a loan for, you can easily vary the loan type and details to suit. Compare different credit facilities, rates and terms to find the best option for your needs.

Let Easy Car Finance simplify the process by taking care of the complicated steps for you